Personal eBanking

Log in and view account balances on the My Accounts page.

First Bank On The Go Mobile App

Log in and view account balances in My Accounts.

Automated Telephone Banking

- Call 800-760-BANK (2265) and choose Option 2.

- Select Option 1.

- Select Option 1.

- Choose your account type: 1 for Checking, 2 for Savings, 3 for Money Market, 4 for Certificate of Deposit.

- Enter your full account number.

- Enter your Personal Identification Number (PIN) to hear your balance.

ATM/ITM

Access your account at any ATM/ITM and choose the Balance Inquiry option from the menu. Find a First Bank location.

The Current Balance is your Ledger Balance plus or minus any current-day online transactions that have not yet completed or cleared. Ledger Balance means the amount of funds in your account reflecting deposits and withdrawals that have posted to your account, and it does not reflect holds, outstanding checks, or any transactions we have committed to pay, but which have not yet been deducted from your account. The Ledger Balance only changes once at the end of each business day.

The Available Balance is the amount of funds available for withdrawal, transfer, and authorization of transactions. The Available Balance reflects pending items and items on hold and any current-day online transactions, and it may change throughout the day. The Available Balance is the amount of money in your account you can use right now without causing an overdraft.

- Personal eBanking: Select your desired account by clicking on it, select the Account Details tab and unmask the account number by clicking the eye icon.

- First Bank On The Go Mobile App: Select the account you wish to view from My Accounts, click the details icon at top of page, click the eye icon in the account number section to view full account number.

- The account number is located at the bottom of a check or deposit slip.

- On a check image in your online account history or on your account statement (if you choose to have images on your statement).

081009428

Some consumer accounts are eligible for online account opening. Visit our personal product page to learn more about our consumer accounts. You may also visit a branch to establish an account.

For account owners 18 years and older:

- U.S. Driver’s License

- U.S. State ID

- U.S. Military ID

- Resident Alien/Permanent Resident Card

- Passport or U.S. Passport card

- Matricula Consular Card (Mexico) or Guatemala Consular ID Card

- U.S. Visa Border Crossing Card

Documents required for minors:

For custodial accounts for minors, Uniform Transfer to Minor Accounts (UTMA), or joint ownership accounts for minors 13-17 with a parent or legal guardian:

- Driver’s permit (must include picture) or one of the above forms of ID *if available

- Birth certificate (when no other form of ID is available)

Please visit your local branch to request a name change. Please bring a copy of your marriage license, divorce decree, or other court document confirming the name change, along with an updated primary identification.

- Personal eBanking: Select Profile in the Self-Service section, select the circle with three dots next to the email address or phone number you want to change.

- First Bank On The Go Mobile App: Select Self-Service from the bottom tool bar, choose My Profile, select the email address or phone number you'd like to change, simply make your edits, and save changes.

- Visit a local First Bank branch or ITM during business hours.

- Contact us at 800-760-BANK (2265).

- For an address change, contact 800-760-BANK (2265) or make an appointment at your local branch.

To remove a deceased owner: Please bring a death certificate into your local branch.

To remove a joint owner after divorce/separation: A living owner may not be removed from an account. The account should be closed and a new account opened. Either owner may request the account closure.

To add an owner: Please visit a local First Bank branch with the new account owner. He or she should bring a primary form of ID.

To add or remove an authorized signer from a business account: A copy of the meeting minutes or resolutions of the Board of Directors authorizing this change, certified by the secretary of the corporation, is required to add or remove a signer. When adding a signer, he or she must present valid identification.

Please provide the required documentation:

- Copy of the page of the trust indicating the name of the trust.

- Copy of the page of the trust showing the grantors and trustees.

- If there are multiple trustees named, the page(s) of the trust documenting that the trustees may work separately.

- Notarized signature page of the grantor(s).

*Please note – special circumstances may require additional pages of the trust.

To add a trustee:

Please provide the required documentation:

- Copy of the page(s) stating that the grantor or trustee may add another trustee. If there are multiple trustees, the page(s) of the trust documenting that the trustees may work separately must also be provided.

*Please note – special circumstances may require additional pages of the trust

Remove a trustee due to incapacity or disability

Please provide the required documentation:

- Copy of the page(s) of the trust that define the documentation required to support incapacity/disability.

- Documentation required as indicated in the trust

- Copy of the page(s) of the trust indicating that the trustees may work separately

*Please note – special circumstances may require additional pages of the trust

Remove a trustee due to death

Please provide the required documentation:

- Certified copy of the death certificate

- If the removal of the deceased trustee requires the appointment of a successor trustee or trustees, the page(s) identifying the successor(s), or the documentation required by the trust for the appointment of the successor trustee. If there are multiple successor trustees named, the page(s) indicating that the trustees may work separately is required.

Remove a trustee due to resignation

Please provide the required documentation:

- A notarized letter of resignation

- If the resignation of the trustee requires the appointment of a successor trustee or trustees, the page(s) identifying the successor(s), or the documentation required by the trust for the appointment of the successor trustee. If there are multiple successor trustees named, the page(s) indicating that the trustees may work separately is required.

- Get account balances.

- Check recent transactions.

- Transfer money between accounts.

- Activate debit card.

- Change debit card PIN.

- Obtain checks that have cleared by check number, date, or dollar amount information.

- Access debit card and deposit transaction history.

- Review your savings, money market, CD, and loan accounts.

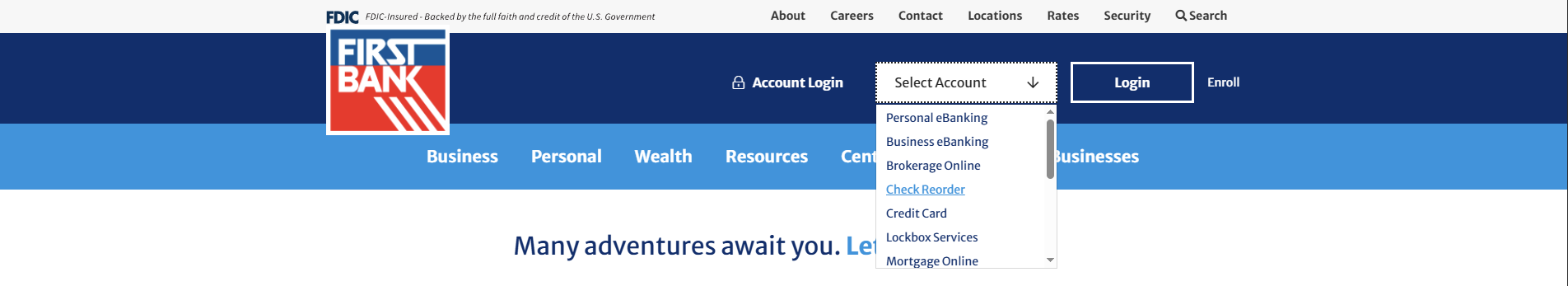

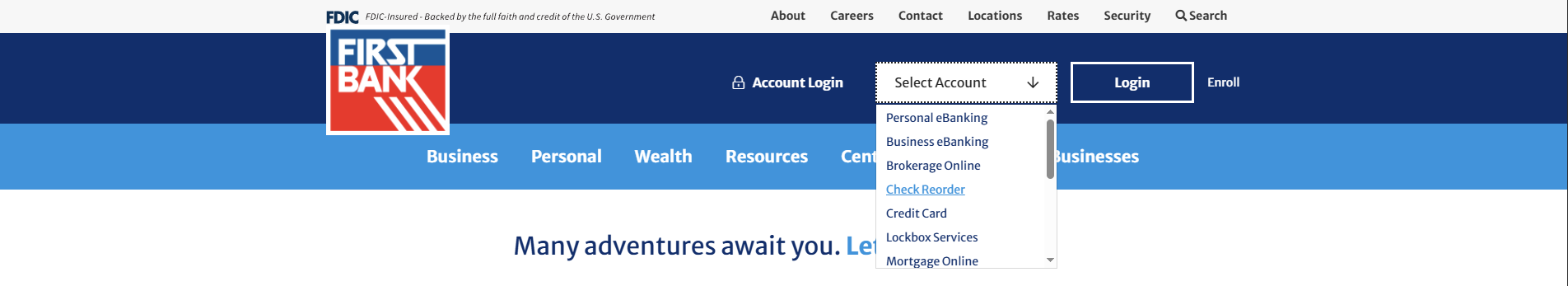

Visit the first.bank website, and select Check Reorder from the Select Account box within the blue Account Login banner located at the top of every page on first.bank. The check ordering website will open to complete the order. You may also order checks by accessing the check order form through this link.

Personal eBanking

After you are logged into your personal eBanking account, select Order Checks in the main menu under Self-Service. Select the preferred account for checks and click Continue. Make sure you do not have pop-ups blocked on your browser. The check ordering website will populate in a new window. Complete your check order.

First Bank On The Go Mobile App

After you are logged into the mobile app, under the Self-Service section, select Order Checks. Select the preferred account for checks and the check ordering website will populate in the mobile app. Complete your check order.

Visit the first.bank website, and select Check Reorder from the Select Account box within the blue Account Login banner located at the top of every page on first.bank. The check ordering website will open to complete the order. You may also order checks by accessing the check order form through this link.

Personal eBanking

From the First.Bank site, select Enroll in the blue toolbar, and follow the prompts to establish your eBanking account and create a Username and Password.

First Bank On The Go Mobile App

Download First Bank On The Go from the app store, and use the username/password you created for eBanking to log in (your login credentials), then set up a Mobile passcode, and if desired, Face or Touch ID for easy login.

For a quick enrollment tutorial, please watch this video.

No, each person who wishes to utilize eBanking should create their own Username and Password. Login information should never be shared with another person.

Check the information you entered for accuracy. If you are unable to successfully enroll, call us at 800-760-BANK (2265).

Go to the Welcome to eBanking page. You may also log in via the blue Account Login banner located at the top of every page on first.bank. Please select your account type from the Select Account box.

Personal eBanking

On the Welcome to eBanking page, select the "I've forgotten my Password" option to receive an email to reset the Password.

First Bank On The Go Mobile App

On the Welcome screen with the Username and Password areas, click "Having trouble logging in?" and select the "I forgot my Password" option to receive an email to reset the Password.

Personal eBanking

On the Welcome to eBanking page, select the "I've forgotten my Username" option to receive an email retrieving your Username.

First Bank On The Go Mobile App

On the Welcome screen with the Username and Password areas, click "Having trouble logging in?" and select the "I've forgotten my Username" option to receive an email about retrieving your Username.

Contact us at 800-760-BANK (2265) for assistance with unlocking your account. Representatives are available Monday- Friday 7am-9pm CST, and Saturday from 9am-5:30pm CST.

Choose Pay Bills or Bill Pay Dashboard from the menu and begin setting up your bill payments and making payments right away!

Yes! First Bank offers our clients the Bill Payment Service (also known as Bill Pay) at no charge. Quick Pay payments may be subject to an additional fee.

Select Add Payee from the Bill Pay Dashboard or the Add Payee section of Pay Bills.

- If the payment method is an electronic payment, the payment amount will be debited from your account on the Send Date.

- If the payment method is a paper check, the payment amount will be debited from your account on the date the check is presented to First Bank for payment and clears your account.

- The cutoff time for payments initiated in Bill Payment is 3:00 p.m. CT on each Business Day.

Review payment information in the Payment Activity section of Move Money.

If the Est. Delivery Date has passed and the payee has not received the payment, please follow the steps below for resolution:

- For electronic payments, contact us at 800-760-BANK (2265) for assistance. An agent will work with our Bill Pay team to locate the payment and provide proof of payment to the payee.

- For check payments, please verify the mailing address for the payee. If the payment is lost, a stop payment can be placed and a new payment can be created. Contact us at 800-760-BANK (2265) to request the check stop payment or utilize Stop Checks in eBanking. A Stop Payment Fee may apply.

- All users of eBanking will have access to electronic versions of account statements (eStatements) in the More section of eBanking. You must select an account in the Select Accounts dropdown menu first. Check the box for the Account, click the up arrow for accounts selected, and this will display the eStatements for the selected Account.

- eStatements are available to view in eBanking and the mobile app.

- If you have chosen to receive a paper statement in the U.S. Mail, you will still receive the paper statement, and there may a fee assessed for the paper statement. See the Personal Schedule of Fees.

- eStatements without check images included on the statement are free.

- If you have elected to receive an eStatement only, and you have chosen to include images of checks on your account statement, there may be a fee assessed. See the Personal Schedule of Fees for “eStatement/Images Fee.”

- If you have elected to receive a paper statement in the U.S. Mail that has check images included on the statement, there may be a fee assessed. See the Personal Schedule of Fees for “Paper Statement/Images Fee.” You will also receive an eStatement with check images included on the statement. You will not be charged the “eStatement/Images Fee.”

- If you have elected to receive a paper statement in the U.S. Mail without check images included on the statement, there may be a fee assessed. See the Personal Schedule of Fees for “Paper Statement Fee.” You will also receive a free eStatement without check images included on the statement.

You will be able to accumulate up to 24 cycles of eStatements. eStatements prior to enrollment in eBanking may not be available online. We recommend saving an electronic copy to your computer for long-term retention.

- Manage your statement delivery options in the More section of eBanking and select Paperless Settings. You may choose to Go Paperless, and we will provide only eStatements (and we will not provide a paper statement in the U.S. Mail). You may also choose to receive a paper statement in the U.S. Mail (in addition to the eStatement provided in eBanking).

- Please note there may be a paper statement fee (with or without images) for your product type.

External Transfer allows you to transfer funds between a First Bank account and accounts that you own at other financial institutions (i.e., an External Account). You may initiate the transfer of funds from your First Bank account to an External Account, or you may initiate the transfer of funds from an External Account to your First Bank account.

There is no fee for setting up transfers in External Transfer.

Within eBanking, select External Transfer & Pay People from the Move Money section. Select Add for an External Account and complete the required information.

Once you have added the External Account, First Bank will begin verifying your External Account. Two small deposits will be made in the External Account within 1-2 Business Days. To verify the External Account, return to External Transfer & Pay People in eBanking, and in the External Account box, click the Activation Required link, enter the deposit amounts, then click Activate.

- Once you select a Send Date, the earliest possible Est. Delivery Date will be indicated in eBanking. Once you select an Est. Delivery Date, eBanking will provide the appropriate Send Date.

- If the transfer is scheduled from a First Bank account to an External Account, the Send Date will be one (1) Business Day before the Est. Delivery Date.

- If the transfer is scheduled from an External Account to a First Bank account, the Send Date will be three (3) Business Days before the Est. Delivery Date.

- The transfer should appear in the External Account or in your First Bank account within 1-3 Business Days after the External Transfer request is completed.

Yes, recurring and future-dated transfer setup is available.

Pay People is a fast, convenient, and safe way to send money to a person from your smartphone or computer. You will see this also referred to as a PayItNow P2P payment.

There is no fee for the Pay People Service.

- Within eBanking, select External Transfer & Pay People in the Move Money section. Select Add for People and complete the required information, providing an email address or mobile number.

- If you use a Person’s mobile number, you must represent that you have the recipient’s consent to use the mobile number for text messages.

- The amount of the payment will be debited from your First Bank account on the Business Day that the Recipient accepts the payment. If the payment is not accepted within 10 calendar days after the processing of the payment begins, the payment will be void, and no funds will be deducted from your account.

- The cutoff time for Pay People payments is 3:00 p.m. CT on each Business Day.

In order for the Recipient to obtain the payment, the Recipient must accept the payment and provide required account information. This must be done within 10 calendar days. Once the Recipient has accepted the payment, the payment will be deposited in the Recipient’s account one (1) Business Day after the Business Day on which the payment was accepted.

You may cancel a payment in Pay People at any time until the processing of the payment into the Recipient’s account has begun. This means that if the Recipient has not accepted the payment, you may cancel at any time by selecting Delete Payment for the scheduled payment.

You can set up recurring payments when using Pay People by choosing a frequency option.

It is a randomly generated one-time code used as an extra layer of protection to confirm your identity when you are accessing your eBanking profile. After you successfully enroll in eBanking, each time you access eBanking, you are able to choose the verification method you prefer, either text message or phone call. The one-time verification code (also known as one-time passcode) is sent by text or confirmed through an automated phone call to a phone number on file with us. By requiring the entry of a one-time verification code and the use of a phone number you have on record, fraud is prevented even if an unauthorized user learns your eBanking Username and Password.

You can access eBanking with a web browser that uses at least a 128-bit encryption.

First Bank’s eBanking and mobile app are not available for use outside of the United States. First Bank reserves the right to restrict activity from countries banned by the Office of Foreign Assets Control (OFAC) and additional countries where fraud trends are prevalent.

QuickBooks Desktop Web Connect Conversion Instructions

QuickBooks Online Conversion Instructions

Quicken Web Connect Conversion Instructions

Personal eBanking

In Self-Service, select Manage Cards, click on the image of your debit card, click Change in the Change PIN section, enter your current PIN, click next, and enter a new PIN. Then save your changes.

First Bank On The Go Mobile App

Choose Self-Service, select Manage Cards, and follow prompts to change PIN.

Self-Service Via Phone (Requires Existing PIN Entry)

- Call 800-760-BANK (2265)

- Option 2 for Self Service

- Option 1 for Personal or Business

- Option 5 for Card-Based Services

- Option 2

- Enter your card number, followed by #

- Enter your current PIN, follow by #

- Option 1 to change your PIN

- Select a new PIN

If you do not know your existing PIN, contact us at 800-760-BANK (2265).

- Personal eBanking: In Self-Service, select Manage Cards, click on the image of your debit card, and choose Replace Card. Within the section, select reason for replacement (Lost, Stolen, or Damaged), and order a new card.

- First Bank On The Go Mobile App: Choose Self-Service, select Manage Cards, choose Replace Card, select your reason for replacement (Lost, Stolen, or Damaged), and order a new card.

- Contact us at 800-760-BANK (2265).

- For after-hours service, contact 855-961-1602.

Personal eBanking

In Self-Service, select Manage Cards, select Travel Notice in the top right corner, and enter the country or city you will be visiting and for how long. Set International Travel Notices to complete an international online purchase.

First Bank On The Go Mobile App

Select Self-Service, Manage Cards, select the three dots in top right corner, and click Travel Notice. Enter the location and duration. Set International Travel Notices to complete an international online purchase.

You may also contact us at 800-760-BANK (2265) to notify us of an international purchase or travel.

*Countries banned by the Office of Foreign Assets Control (OFAC) are restricted from debit card usage. First Bank reserves the right to restrict activity from additional countries where fraud trends are prevalent.

- Non-Authorization request transactions

- Recurring transactions

- Credit transactions (Returns, Deposits, etc.)

An account is evaluated each month on a specific Evaluation Date to determine if qualifications were met during a monthly Qualification Period; this Evaluation Date is three business days before the account’s Analysis/Statement Date which is on the 5th of each month. On the Analysis/Statement Date, interest is credited to the account, a monthly maintenance fee may be assessed, and the account statement is generated. The Evaluation Date is the last day of the monthly Qualification Period which begins one business day after the previous month’s Evaluation Date, and it is similar to a lookback period. Qualifying transactions must post to the account during the monthly Qualification Period. Transactions may take one or more business days from the date of purchase to post to the account. Qualifications to earn a premium interest rate are:

- 15 or more debit card purchases

When all of the above qualifications are met and posted to the account during a monthly Qualification Period, the account is a Qualifying Account, and effective on the business day after the Evaluation Date, a premium interest rate of 1.49% will be paid on the portion of the account balance up to $25,000.00 (the APY for this tier will be 1.50%); and the portion of the account balance that is $25,000.01 or more will be paid a lower interest rate of 0.05% (the APY for this tier will range from 1.50% to 0.05%, depending on the balance in the account); the account will be considered a Qualifying Account through the next Evaluation Date. When all the above qualifications are not met and posted to the account during the monthly Qualification Period, the account is a Non-Qualifying Account, and effective on the business day after the Evaluation Date, a lower interest rate of 0.05% will be paid on the entire account balance (the APY will be 0.05%); the account will be considered a Non-Qualifying Account through the next Evaluation Date.

When the qualifications of 5 or more debit card purchases are met and posted to the account during a monthly Qualification Period, the monthly maintenance fee of $15.00 will not be assessed on the Analysis/Statement Date following the Evaluation Date. When the qualifications of 5 or more debit card purchases are not met and posted to the account during a monthly Qualification Period, the monthly maintenance fee of $15.00 will be assessed on the Analysis/Statement Date following the Evaluation Date.

Interest Rates and Annual Percentage Yields (APYs) are accurate as of 03/05/2026. First Performance Checking is a variable-rate account, and the interest rates for a Qualifying Account and a Non-Qualifying Account may change after the account is opened. $100 minimum balance to open. Fees may reduce earnings. Limit one First Performance Checking account per person. Interest Rates and APYs apply to accounts that were opened on or before 10/13/2023.

The interest rate will display as 0.00% because the account can earn two different interest rates at the same time (a premium interest rate for balances of $0.01 to $25,000.00 and a lower interest rate for balances $25,000.01 and over). If the interest rate is displayed as 0.00%, this signifies that it is a Qualifying Account and is earning the highest interest tier at that time.

Yes, once the first statement has generated you will be able to see the APY earned and interest earned on the account. After the first statement this will also populate the values in eBanking for the Last Statement APY earned and Interest YTD section.

If you are using mobile wallet functionality (Apple Pay, Samsung Pay, Google Pay) where the purchase transaction is utilizing the First Bank debit card tied to your First Performance Checking, then yes, it will look just like a regular debit card purchase. Account to Account transfers utilizing mobile wallet or an incoming Zelle transfer that uses the debit card do not count as a debit card purchase.

Once you have completed eBanking enrollment, you may download First Bank On The Go from the app store on your mobile device and sign in using your login credentials.

- Check balances and transfer funds.

- View account history and pending transactions.

- View images of cleared checks and eStatements.

- Bill Pay, External Transfer, Pay People, and add Payees.

- Manage payments in the Bill Pay Dashboard.

- Deposit checks with the Mobile Remote Deposit Service (also known as Mobile Deposit).

- Manage your Debit Card.

- Locate your nearest First Bank branch, ITM, or ATM.

Skip a trip to the bank! Select Deposit a Check in Move Money and follow the instructions to capture an image of the front and back of the check. Select Verify to process the deposit.

Mobile Deposits made after 8 p.m. (CT) will be processed the next business day.

We may at our sole discretion place a 3-business-day hold on any Mobile Deposit submitted.

We may impose transaction, daily and monthly limits that may change from time to time based on our discretion. To inquire about limits or to request a limit increase, please contact us at 800-760-BANK (2265).

Access your financial situation:

- Know your credit score

- Know the current balances on your unsecured personal loans (ex: credit cards, student loans)

- Do you have the funds available for a potential down payment, moving expenses, utilities, home furnishings, or unforeseen emergencies?

To help guide you through the home loan process, contact a First Bank Home Loan Advisor. One of our friendly team members can help you determine the type of mortgage and loan amount that’s comfortable for you, based on your individual financial position.

A general rule of thumb for determining if you can qualify for a new mortgage is to use 33% of your gross monthly income for housing. The housing payment includes the monthly principal and interest on the mortgage, plus the property taxes and homeowners insurance. It is a good idea to also consider all the monthly amounts for car payments, leases, and revolving credit cards, plus the new housing payment at 38% of your gross monthly income. Our Mortgage Home Loan Advisors can easily assist you to ensure you are able to qualify for the home you are considering purchasing.

Generally you will need enough funds for your down payment, closing costs and two months of your new payment in reserves.

There are many acceptable sources of funds that you can use for a down payment. The most common are: personal savings or checking account, gift from a family member, 401(k) account, and down payment assistance programs. A Mortgage Home Loan Advisor is there to assist you with these options and more.

While it seems like one extra unnecessary step, a pre-approval strengthens any offer you make once you have decided on a home to purchase.

It would be nice to wait for a lower rate; however, at the same time, the price of the home can also increase. If you are ready to buy, that is usually the time you should buy! First Bank is always ready to assist you in the most important purchase of your life - owning your own home. Feel free to call upon any of our loan advisors to answer your questions and put you on the road to home ownership!

Ready to start the home loan process? One of our Home Loan Advisors is ready to serve you. Find a First Bank Loan Advisor.

1099/1098 Statements are mailed by January 31.

Consumers receive 1099-INT Statements if the total interest of all of their accounts, in which their social security number is listed as the primary owner, equaled $10 or more during the tax year.

Business accounts do not receive a 1099-INT Statement.

1098 Statements are sent to those individuals with real estate secured loans that have paid $600 or more of interest during the tax year.

1098 Statements are not produced for corporations, partnerships, trusts, estates, associations, or companies (other than sole proprietorships).

If a distribution occurred during the tax year on your IRA, you will receive a 1099-R Statement.

No, the interest earned on an IRA is non-taxable.

The information on a 5498 Statement is submitted by the issuer of your IRA to report contributions, including any catch up contributions, rollovers, direct rollovers, re characterizations, and conversions, as well as the Fair Market Value (balance as of December 31) for each person who maintained an IRA the prior calendar year. The 5498 Statements are mailed prior to May 31st.

To transfer between your personal accounts:

- Personal eBanking or First Bank On The Go Mobile App: Choose Make Transfers in the Move Money Section.

- At a First Bank ITM with a Virtual Banker.

- At a First Bank ATM between primary linked accounts.

- From your personal account to an account you own at another financial institution: see External Transfer.

- From your personal account to another person: see Pay People.

- You may also visit a First Bank location to request a wire transfer (a fee may apply). Review the wire transfer instructions.

- Write a check to yourself from the business account and complete a Mobile Deposit into your personal account through the First Bank On The Go app.

- Visit your local branch or ITM during business hours.

- One-time transfers with a “Transfer Date” set to the current date and made by 10 p.m. CT on a Business Day will be posted on the same Business Day, and will be reflected in your Current Balance and Available Balance and shown in the transaction history as “Pending.”

- Transfers made after 10 p.m. CT or on a holiday or non-Business Day will be posted the next Business Day.

- On the Transfer Date, the transfer amount will be reflected in your Current Balance and Available Balance and shown in the transaction history as “Pending.”