Financial planning is a crucial aspect of managing your finances, particularly when it comes to investments and retirement planning. Creating a financial plan with a trusted professional will not only increase your chances of a successful retirement, but it should also provide clarity and peace-of-mind to live a full and productive life. A simple way of thinking about this is that it provides the ability to treasure the past, embrace today, and plan for tomorrow.

How do People Feel About Financial Planning?

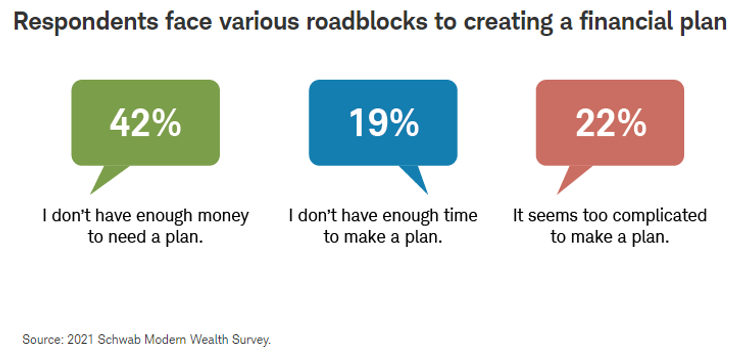

To put this into perspective, below are results from a recent surveyˡ with the “roadblocks,” or internal reasons, financial plans are often not created for wealth and retirement.

If we look at the three categories above of 1) Not having enough money, 2) Scarcity of time, and 3) Financial planning seems too complicated; these reasons or excuses are truly not valid for most individuals and families. When I discuss the peace of mind and clarity that financial planning can bring to clients, from the same survey, the results showed a material difference for those having financial plans versus those not having financial plans.

- 65% of people with a written financial plan say they feel financially stable compared to

40% of those without a plan that say they feel the same level of comfort. - 54% of clients with a financial plan felt "very confident" they would reach their financial goals, compared to only 18% of clients without a plan.

Taking these survey results into consideration, there is no reason for people to let excuses get in the way of feeling financially stable and confident about reaching their financial goals.

The Process:

People that have not gone through prudent financial planning may not be aware of the various aspects of going through the process in planning for a successful retirement.

- Setting Goals: Financial planning can help you set realistic investment and retirement goals based on your current financial situation and your future needs. This is a time for you to think about your retirement dreams and truly plan for life after work.

- Budgeting: A financial plan can help you create a budget, which can help you allocate your resources more efficiently and allow you to identify areas where you can cut expenses.

In my experience, those clients that previously had a lower probability of success to achieve a successful retirement, we’ve worked together to help them:

- Save more of what they earn,

- Invest more of what they save,

- Diversify more of what they invest.

- Risk Management: Financial planning can help you identify and manage risks associated with investments and retirement planning. For example, you can plan for unexpected events, like job loss, long-term disability, long-term care events, or market downturns by creating an emergency fund and diversifying your investments.

- Maximizing Returns: A financial plan can help you invest your money in a way that maximizes returns while minimizing risk. This can help you grow your wealth faster and reach your financial goals sooner.

- Tax Planning: Financial planning can also help you minimize your tax liability by identifying tax-efficient investment strategies and retirement accounts. This is a pivotal component of financial planning that is often overlooked. Minimizing tax rate risk and understanding the tax buckets in retirement can have a very powerful impact on maximizing your wealth.

- Retirement Planning: With a financial plan, you can estimate how much money you'll need to save for retirement and create a strategy to reach those goals. This can help you retire comfortably and with financial security. Not only does this create a blueprint to success for your retirement, but at the same time, provides great peace of mind. When the bond and equity markets have great volatility, like we experienced in 2022, referring back to one’s financial plan and understanding the long-term goals and strategies, tends to reduce stress and anxiety that down markets can have on any future retiree.

Overall, financial planning can help you make informed decisions about your investments and retirement planning, which can lead to better financial outcomes in the long run.

Financial Planning Tool:

At First Bank Wealth Management, we utilize the latest tools, technology, and resources to assist us in developing a long-term financial plan for you. MoneyGuidePro® is a best-in-class financial planning software that we utilize to help individuals and families create comprehensive financial plans. We walk through the various parts of your financial journey and put the power of our experience coupled with the math to work through this software.

Additional benefits of utilizing this tool are:

- Review and update regularly: Review and update your financial plan regularly, especially when there are significant changes in your financial situation or life events, such as marriage, having children, or changing jobs. The plan is designed to be easily updated for life changes or adjusting to different goals or dreams for your retirement.

- Consider various scenarios: MoneyGuidePro® can help you create different scenarios for your financial plan, such as best-case, worst-case, and average scenarios. This can help you see how your plan may perform under different circumstances. Leveraging Monte Carlo analysis, MoneyGuidePro® runs 1,000 different scenarios of market performance over the retirement period to determine a projected success rate. This is a great tool that we often use to analyze if our clients are on track to reach their dream retirement goals or if adjustments to the strategy need to be considered and implemented.

- Understand risk tolerance: MoneyGuidePro® can help determine your risk tolerance, which is your ability and willingness to tolerate market volatility. Understanding your risk tolerance can help you make more informed investment decisions that align with your risk profile.

- Address estate planning: Consider including estate planning in your financial plan, including wills, trusts, and powers of attorney. MoneyGuidePro® can help estimate your estate tax liability and create an estate distribution plan.

By considering these additional factors when creating a financial plan, we can ensure that your plan is comprehensive and tailored to your unique financial situation and goals.

In summary, integrating our financial planning process is a powerful tool to empower you to dream big, create strategies to live out your dreams throughout your journey, and to enjoy the retirement of your dreams. Regular meetings with a trusted First Bank Wealth Management Advisor is recommended to review your plans and adapt to any life changes and goals.

Charles Claver |

Charles Claver is the Senior Vice President and Director of the Private Wealth Advisor team for First Bank Wealth Management. Possessing 25 years of experience in the financial services field, his expertise includes investment management, trust and retirement planning, individual/commercial insurance, and private banking/lending. You may reach him at (310) 887-0100 or via email at [email protected]. |

IMPORTANT DISCLOSURES

Investment and insurance products are offered through OSAIC INSTITUTIONS, INC., Member FINRA/SIPC. Osaic Institutions and First Bank are not affiliated. Osaic Institutions does insurance business in California as Osaic Institutions Insurance Agency, CA Agency License #OH30186. Products and investment advisory services made available through Osaic Institutions are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value. First Bank Wealth Management is a trade name of First Bank, and certain products and services are provided through First Bank, and its affiliates and subsidiaries. Neither Osaic Institutions or First Bank, nor any of their affiliates or financial advisors, provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions. Use FINRA’s BrokerCheck to learn about the professional background, certifications, licenses, and any regulatory violations or complaints for any financial advisor.

NON-DEPOSIT PRODUCTS: ARE NOT INSURED BY THE FDIC; ARE NOT DEPOSITS; AND MAY LOSE VALUE.